State Of Ohio Employee Tax Forms

We last updated the Employees Withholding Exemption Certificate in March 2021 so this is the latest version of Form IT 4 fully updated for tax. We last updated Ohio Form IT 4 in March 2021 from the Ohio Department of Taxation.

Unclassified Background Check Form A Background Information Unclassified Background Check Form B Disclosure Questionnaire Unclassified Background Check - Limited Tax Waiver Form.

State of ohio employee tax forms. JFS-00501 Employers Representative Authorization for Benefits. This form states that the newly hired employee has no known or undisclosed relatives or business associates employed by the State of Ohio or any business interests which are involved with state business. School District Withholding forms-Must be filed Electronically via OBG.

Used by employers to. To the Ohio Department of Taxation Ohio IT 941. Employers engaged in a trade or business who pay compensation Form 9465.

This form must be filled out as a part of the new hire process. Employers and their employees use this form to enter into a contract of employment outside of Ohio when some or all of the work is to be performed outside of Ohio and there is a possibility that the workers compensation laws of both Ohio and another state could apply. If applicable your employer will also withhold school district income tax.

Vidual estimated income tax form IT 1040ES even though Ohio income tax is being withheld from their wages. Unclassified Background Check Form. Tax Exempt forms united states tax exemption form current revision date 04 2015 this is a list of forms from gsa and other agencies that are frequently used by gsa employees state tax exempt forms visit smartpaya to find state tax exemption forms and or links directly to state websites united states.

Furnish to all employees on whom tax was or should have been withheld two copies of the report of compensation paid during the calendar year and of the amount deducted and withheld as tax. New Paris Ohio To Champaign Illinois-June 1 2018 ohio form it. Employees Withholding Certificate Form 941.

Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax. 2020 Ohio IT 1040 Individual Income Tax Return - This file includes the Ohio IT 1040 Schedule A IT BUS Schedule of Credits Schedule J IT WH IT 40P IT. Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return electronically.

NEW HIRE REPORTING CENTER P O Box 15309 Columbus OH 43215-0309 Fax 1-888-872-1611 OHIO EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE IT 4 wwwtaxohiogov. In the new system by creating an account a security code will be sent to licensees within the next few weeks which will allow licensees to create their account in the new system ohio state board of cosmetology BigRigTravels LIVE. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Ohio government.

Mail or fax the form no later than 20 days after an employee is hired. Tax forms Ohiogov Official Website of the State of Ohio. Employment Eligibility Verification Form Form I-9 Supplemental Employment Agreement ADM 4288 Supplemental Nepotism Statement ADM 4173 Drug Test Notification Form if applicable--click here for testing designated positions PERS Personal History Record Social Security Form Federal Tax Withholding Form W-4 State Tax Withholding Form IT-4.

Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Benefits. Employers may use federal W-2 or 1099-R.

Other Tax forms A complete database of state tax forms and instruction booklets is available here. SD101 School District Withholding File Upload Instructions for Ohio Business Gateway. This result may occur because the tax on their combined in-come will be greater than the sum of the taxes withheld from the husbands wages and the wifes wages.

OBM has not undertaken nor has any obligation to update any information included on these pages and cannot guarantee the accuracy timeliness or completeness of this information. Have your employees complete Form 7048. The employer is required to have each employee that works in Ohio to complete this form.

This requirement to file an individual estimated income tax form. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125. JFS-20129 Request to Amend the Quarterly Tax Return.

The employee uses the Ohio IT 4 to determine the number of exemptions that the employee is entitled to claim so that the employer can withhold the correct amount of Ohio income tax. Gsa Tax Exempt form Texas. C-110 - EmployerEmployee Agreement to Select Ohio as the State of Exclusive Remedy for Workers Compensation Claims.

Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information directly to a representative. Employers Quarterly Federal Tax Return Form W-2. Employer Withholding forms- Must be filed Electronically via OBG.

Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate. The Ohio Office of Budget and Management OBM maintains the Bond and Investor Relations web pages. Ohio form It 3 for 2018.

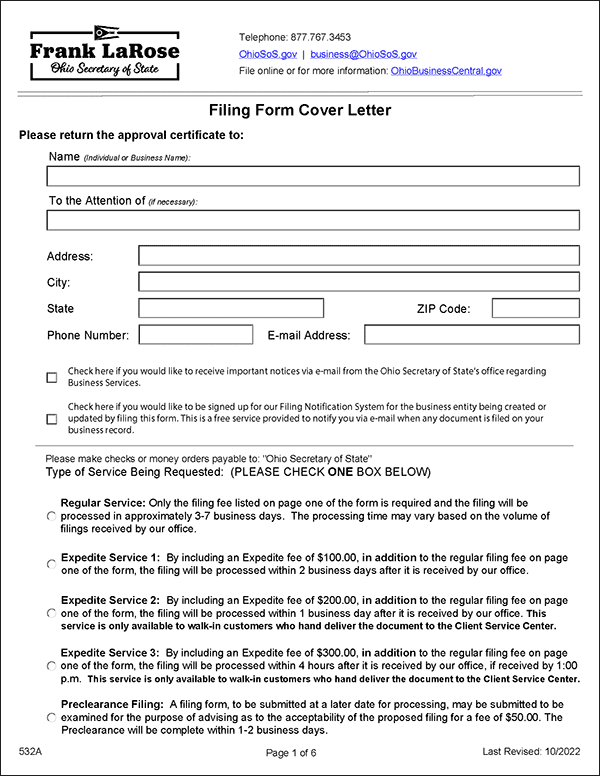

Llc Ohio How To Start An Llc In Ohio Truic

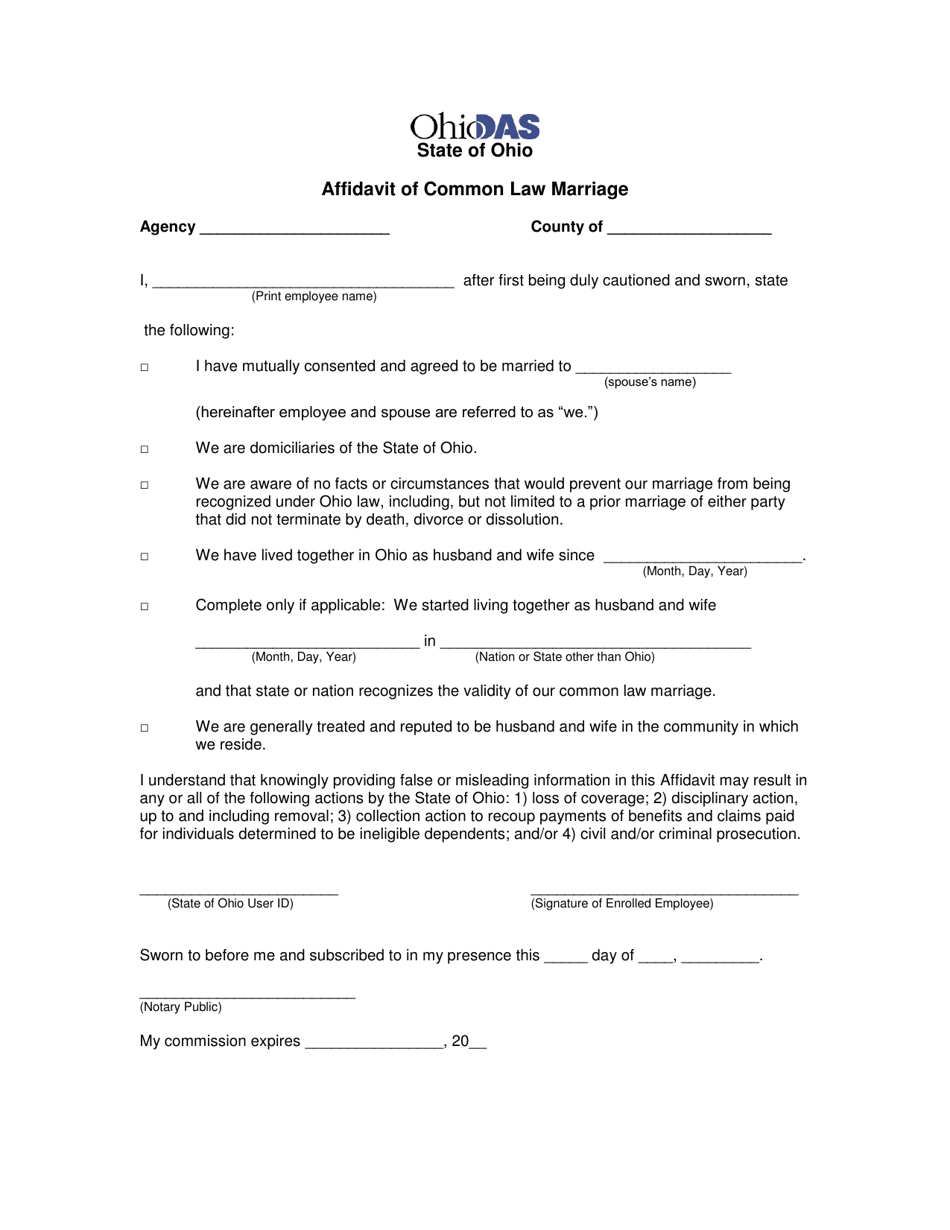

Form Adm4731 Download Fillable Pdf Or Fill Online Affidavit Of Common Law Marriage Ohio Templateroller

Income Tax City Of Gahanna Ohio

How To Fill Out Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Income Taxes Ohio Gov Official Website Of The State Of Ohio

Tax Forms Department Of Taxation

2020 Instructions For Schedule H 2020 Internal Revenue Service

State Of Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

State W 4 Form Detailed Withholding Forms By State Chart

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Employer Withholding Department Of Taxation

State W 4 Form Detailed Withholding Forms By State Chart

Income Tax City Of Gahanna Ohio

Opers Tax Guide For Benefit Recipients

2020 Instructions For Schedule H 2020 Internal Revenue Service

Post a Comment for "State Of Ohio Employee Tax Forms"