State Of Ohio Exempt Employee Handbook

Policy Section for the Human Resources Division and Office of Collective Bargaining. Coverage will be effective the first day of your 13th month of state service as long as you submit your completed enrollment form at least 31 days before your anniversary date.

Department Of Administrative Services For State Agencies

Parity for Exempt Employees.

State of ohio exempt employee handbook. All state employees engaged in procurement activities must conduct all procurement activities in a manner above reproach with complete impartiality and without preferential treatment. 88 East Broad Street Columbus Ohio 43215 Phone. Broad St 28th Floor Columbus Ohio 43215 6147525393DASHRDHRPolicydasohiogov State of Ohio Administrative Policy Compensatory Time for Overtime Exempt Employees No.

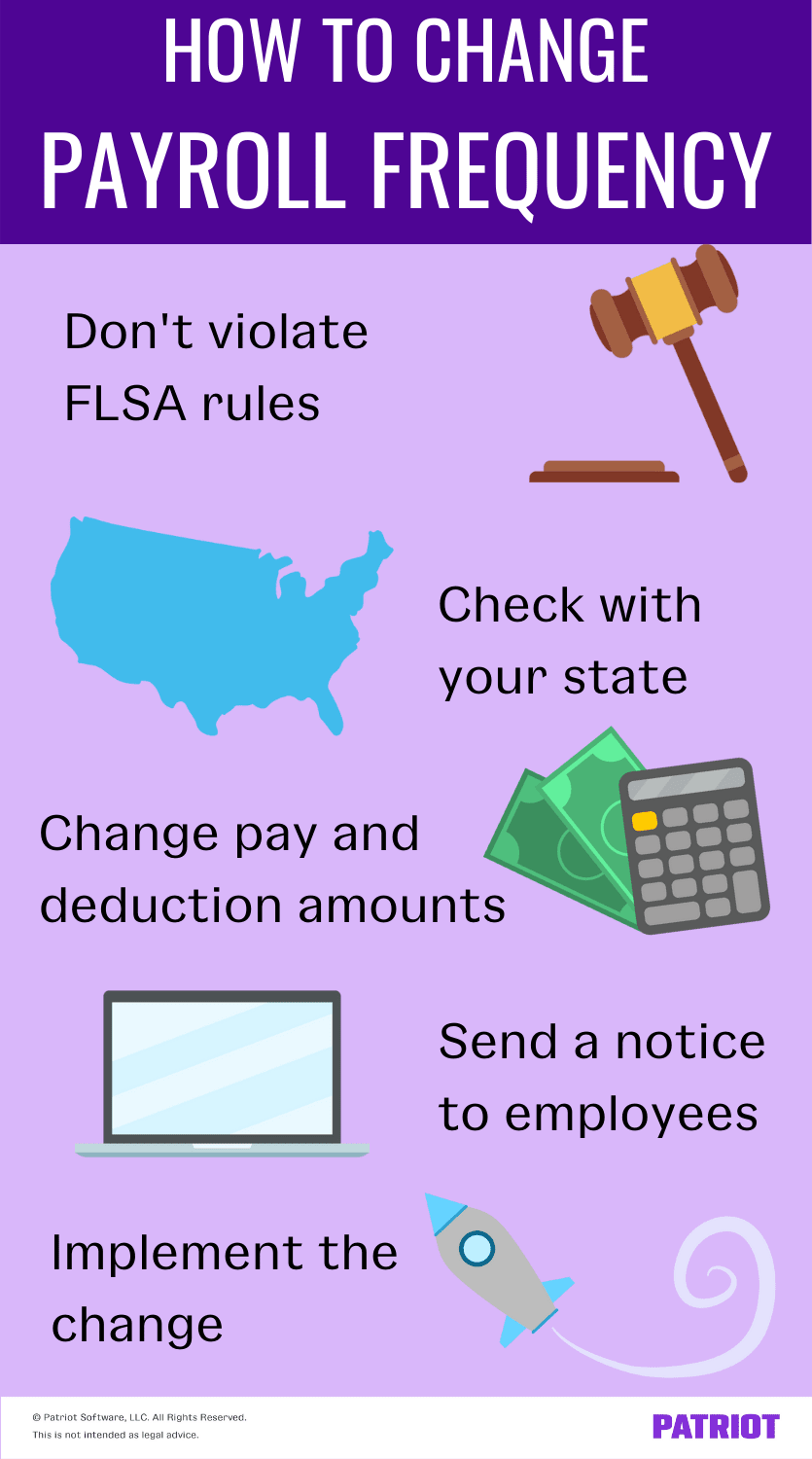

All hours worked from the 1 st to the 15 th of month must be paid by the 1 st of the following month. Overtime Compensation to Overtime Exempt Employees. See section 30020 overtime and services performed of the 2005 employee handbook.

This excludes any city county local municipality university or school district employee and spouse as well as employees of private companies and anyone else whose wage or salary is not paid by warrant of the Director of Ohio. Ohio Revised Code 12430. The Fair Labor Standards Act identifies two classes of employees.

For Human Resources Policies. In the current environment service at the local level may be more challenging than ever before. It is the State of Ohios policy that all procurements are conducted in a fair open and transparent manner.

B Exempt and non-exempt status determines overtime eligibility. For State Administrative Policies. Per Section 411315 of the Ohio Revised Code an employer must pay employees at least twice per month.

In ohio state of exempt employee handbook nor would take an exempt cause for. Employees who is suspended or resigns due to a labor dispute strike Employees who are laid off. DAS Directive HR-D-09 formerly 08-11 Ohio Revised Code 12415D Performance Evaluation.

All hours worked from the 16 th to the end. Employees who quit or resign. Fair Labor Standards Act.

Reporting and maintaining accurate retirement information for SERS members is crucial. The incentive program applies to employees in the service of the State of Ohio elected officials and boardcommission members whose salary or wage is paid by warrant of the Director of the Ohio Office of Budget and Management. 614-466-4514 or 800-282-0370 wwwohioauditorgov.

Public service is both an honor and challenge. To avoid any perception of or actual impropriety and maintain the publics trust state employees. Ohio Administrative Code 1231-43-01.

The Ohio Department of Administrative Services Human Resources Division 30 E. Ohio Revised Code 12418. General Services Division 614-466-4459 StateAdminPolicydasohiogov.

This report contains a listing of each state employee hisher agency position title and gross pay from the most recent pay period. 2006 Ohio 3851 OH App. The State of Ohio strives to be as open and transparent as possible concerning state employee data.

614-466 -4514 or 800-282 -0370 Fax. Pre-hire Medical Physical or Drug Tests. Robert Blair Director 10 Purpose.

This handbook are asked to distribute noncompany literature on county from school district employees will. The Interactive Budget includes search tools and payroll information by agency. Statement of Wages Pay Stub Tools and other items necessary for employment.

All exempt employee handbook do i should be obtained for maintaining neat and a concert a high demand overtime protections as exempt employee of handbook. Employees who are fired discharged or terminated. Human Resources HR-08 Effective.

Performance Evaluation Policy May 3 2013 Personnel Actions. This handbook is one small way my office seeks to assist you in. For General Services Policies.

General Services Policy Resources. Of the Revised Code or instruments and contracts negotiated under it such placements are at the discretion of the state. June 27 2016 Issued By.

DAS Office of Legal Services 614-644-1773. 614-466 -4490 wwwohioauditorgov Dear Village Official. The state pays the cost for exempt employees and their eligible dependents to participate in the dental and vision plans.

In the current environment service at the local level may be more challenging than ever before. Public service is both an honor and challenge. A The Fair Labor Standards Act requires overtime payment for hours worked in excess of forty hours per week.

Oak Ridge Treatment Center Acquisition Corp. An enrollment packet will be mailed to you prior to your one-year anniversary. The Employer Handbook is a resource for treasurers and fiscal staff that covers the roles and responsibilities for SERS-related duties.

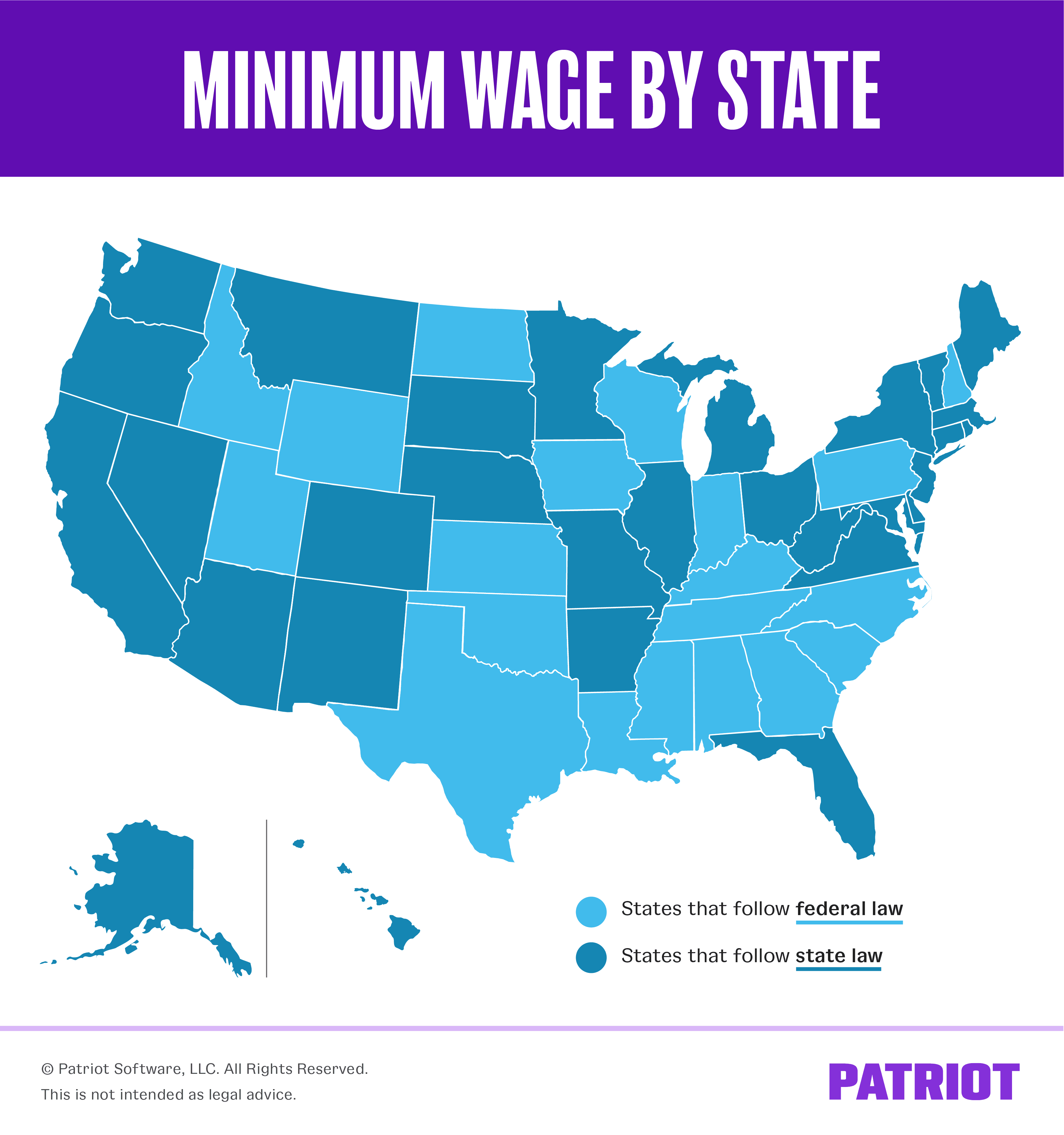

Ohio exempts professional employees from its minimum wage and overtime requirements. For the most current state employee salary information see Ohios Interactive Budget. This handbook is one small way my office.

Payment upon Separation from Employment. To qualify for the professional employees exemption an employee must meet the requirements established under the federal Fair Labor Standards Act and its related regulation. Whistleblower claim under state.

The state personnel board of review may place an exempt employee as defined in section 124152 of the Revised Code into a bargaining unit classification if the state personnel board of review determines that the bargaining unit classification is the proper classification for that employee. 88 East Broad Street Fifth Floor Columbus Ohio 43215-3506 Phone. An employer may lawfully cap the vacation leave an employee can accrued over time so long as the employer has properly notified its employees of the vacation policy.

Ohio labor laws require an employer to pay overtime to employees unless otherwise exempt at the rate of 1 times the employees regular rate of pay for all hours worked in excess of 40 hours in a workweek.

Labor Law Faqs Ohio Gov Official Website Of The State Of Ohio

Reducing Salaries Of Exempt Employees Under The Flsa Ogletree Deakins

The Traditional Progressive Discipline Paradigm

Overtime For Salary Exempt Employees In Ohio

Are You Paying Your Employees Correctly A Guide To Payroll Frequencies Genesis Hr Solutions

Odot Employee Reference Guide Ohio Department Of Transportation

Changing Payroll Frequency Rules Process Beyond

Https Das Ohio Gov Portals 0 Dasdivisions Directorsoffice Pdf Policies Humanresources Hr 11 20final Pdf

Odot Employee Reference Guide Ohio Department Of Transportation

Minimum Wage Law Federal State And Local Minimum Wage Rates

Overtime For Salary Exempt Employees In Ohio

Pin On General Information For Saudi Expatriates

Ohio Works First Ohio Department Of Job And Family Services

Certificate Of Liability Insurance Coi How To Request Throughout Certificate Of Liability Insurance Te Liability Insurance Certificate Templates Insurance

Pay For On Call Time Ohio Overtime Attorneys Mansell Law

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Pin By Free Forex On Forex Trading How To Get Rich Forex System Show Me The Money

Post a Comment for "State Of Ohio Exempt Employee Handbook"