How Does Ohio Deferred Compensation Work

These types of plan are non-qualified tax-deferred plans which means that they are allowed to grow tax-free before the money is withdrawn. Unlike a 401 k your deferred compensation account is not yours.

Essentially a deferred compensation plan allows an employee to set aside a portion of their income over a prolonged period of time while it earns interest while forgoing the tax implications of having such a high compensation structure at the present time.

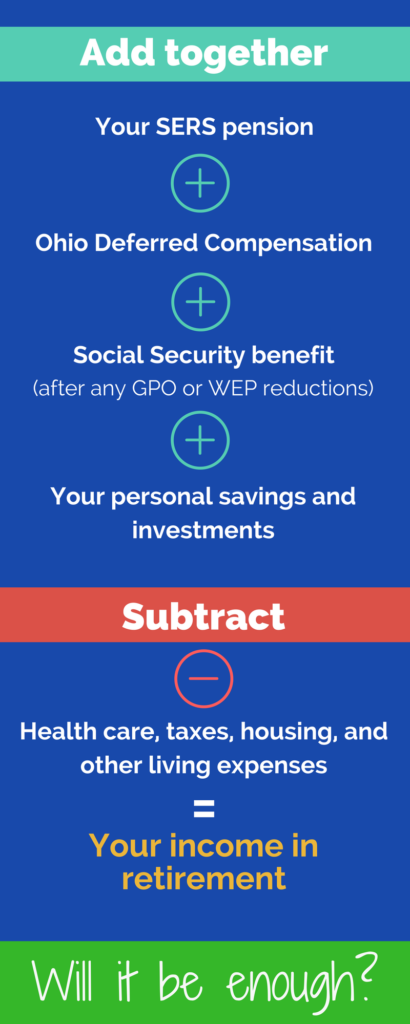

How does ohio deferred compensation work. Your company will designate an amount you may defer and for how long you may defer that amountusually five years 10 years or until you retire. Ohio Deferred Compensation offers a convenient low-cost way for Ohio public employees to save for retirement. The Board is comprised of a member of the Ohio.

You can cancel your participation before your forms are processed by calling 877-644-6457 within seven days of the date signed on this form. The Ohio Deferred Compensation program is Ohios 457 voluntary retirement savings plan offered to state and local government employees. 2019 All Rights Reserved.

For example if you. Based on market fluctuations the rate of return on your account could be either positive or negative. Deferred compensation plans are essentially an IOU from your employer.

It is the property of your employer and is subject to potential loss. After you determine how long you will defer your income you will also need to decide if you want to receive your deferred compensation in one lump sum or across multiple years. It is widely used as a retirement.

Ohio Deferred Compensation INTRODUCTION In 1977 Ohio Deferred Compensation began to offer Ohios state and local government employees a supplemental retirement program administered in accordance with Internal Revenue Code Section 457. Deferred compensation plans are becoming more popular for higher-income earners. Withdrawals are taxed as ordinary income.

However unlike 401k plans the IRS doesnt limit how much income you can defer each year so. What Is a Nonqualified Deferred Compensation NQDC Plan. The primary benefit of most deferred compensation is the deferral of tax to the dates at which the employee receives the income.

Deferred compensation is often referred to as non-qualified deferred comp or the proverbial golden handcuffs. In most cases taxes on this income are deferred until it is paid out. You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our.

With a 457b plan like Ohio Deferred Compensation you can put some of your taxes on hold by reducing the amount of taxes withheld from your pay. If the company goes bankrupt or is unable to pay its bills you may lose the compensation you deferred. Non qualified deferred compensation is very flexible once you understand the rules of engagement.

Like a 401k you can defer compensation into the plan and defer taxes on any earnings until you make withdrawals in the future. Deferred compensation is a portion of an employees compensation that is set aside to be paid at a later date. Deferred compensation is an agreement between an employer and an employee in which a portion of their earnings or compensation for work performed is held back or deferred for payment at a future time.

How Deferred Compensation Plans Work. Deferred compensation is an arrangement in which a portion of an employees income is paid out at a later date after which the income was earned. How does deferred compensation work.

Your account balance will be held by Ohio Deferred Compensation in trust on behalf of your employer for the exclusive benefit of you or your beneficiaries. If the company goes bankrupt deferred compensation is considered an unsecured debt of the company and may mean a total loss. The Programs oversight body is a 13 member board as prescribed by Ohio Revised Code Chapter 148.

Examples of deferred compensation include pensions retirement plans and employee stock options. My recommendation stay away from the deferred comp plan if you have even a hint of concern about the financial future of your employer. Any public employee eligible to enroll in one of the states pension funds is eligible to enroll in the plan.

Please keep in mind that due to IRS regulations you normally cannot withdraw your retirement savings from Ohio DC until you have terminated employment or qualify for an unforeseeable emergency. These plans do not have an annual contribution. You can also establish beneficiaries for your deferred compensation.

Participants invest pre-tax dollars in a tax-deferred account similar to a 401k or 403b retirement plan. You may begin making withdrawals if you retire or leave your current job. There are two types of deferred compensation plans.

When the money is withdrawn it is taxed at the owners income tax rate. Outdated or Unsupported Browser. Compensation can also come in many forms W2 or 1099 and for.

JGunsch Deferred compensation disbursements are generally not requested by the employee until after she or he retires. Deferred compensation plans look a bit different than the 401k you already know. Ohio Deferred Compensation 877-644-6457 257 East Town Street Suite 457 Columbus Ohio 43215-4626 Account Executives are Registered Representatives of Nationwide Investment Services Corporation member FINRA.

Nonqualified deferred compensation NQDC plans and qualified deferred compensation plans. Deferred compensation plans are essentially agreements your employer makes with you saying that youll receive compensation at some point in the future.

Dos Don Ts Of Non Qualified Deferred Compensation Plans

Ohio Deferred Compensation Launches Financial Wellness Program

Https Www Ohio457 Org Assets Newsandpublications Focusnewsletters 2020 4q Focus Newsletter Pdf

Https Www Brecksville Oh Us City 20hall Chpdfs Council Legislation 2021 March 203 202021 20210302 20o 205394 20authorize 20adoption 20agreement 20with 20ohio 20deferred 20compensation 20for 20roth 2045 Pdf

Https Www Sscc Edu Hr Docs Summary Ohio Deferred Compensation Program Pdf

Ohio Deferred Compensation Posts Facebook

Saving For The Future Perspective

Https Ohioauditor Gov Auditsearch Reports 2015 Ohio Public Employees Deferred Comp Program 14 Franklin Pdf

Https Www Brecksville Oh Us City 20hall Chpdfs Council Legislation 2021 March 203 202021 20210302 20o 205394 20authorize 20adoption 20agreement 20with 20ohio 20deferred 20compensation 20for 20roth 2045 Pdf

Https Www Brecksville Oh Us City 20hall Chpdfs Council Legislation 2021 March 203 202021 20210302 20o 205394 20authorize 20adoption 20agreement 20with 20ohio 20deferred 20compensation 20for 20roth 2045 Pdf

Deferred Compensation Ohio Gov Official Website Of The State Of Ohio

Https Www Ohio Edu Sites Default Files Sites Hr Files Ohio Deferred Compensation Guide Pdf

Http Www Loraincountyesc Org Downloads 54 20ohio 20deferred 20compensation 20program Pdf

Ohio Deferred Compensation Now Offering Enrich Financial Wellness Platform To Current And Retired Participants Pr Com

Post a Comment for "How Does Ohio Deferred Compensation Work"