Can Seasonal Employees Collect Unemployment In Ohio

Actually only construction workers and agricultural workers seem to qualify for what was once a wider pool of unemployed seasonal workers. General Information fact sheet at jfsohiogovfactsheetsucregularpdf.

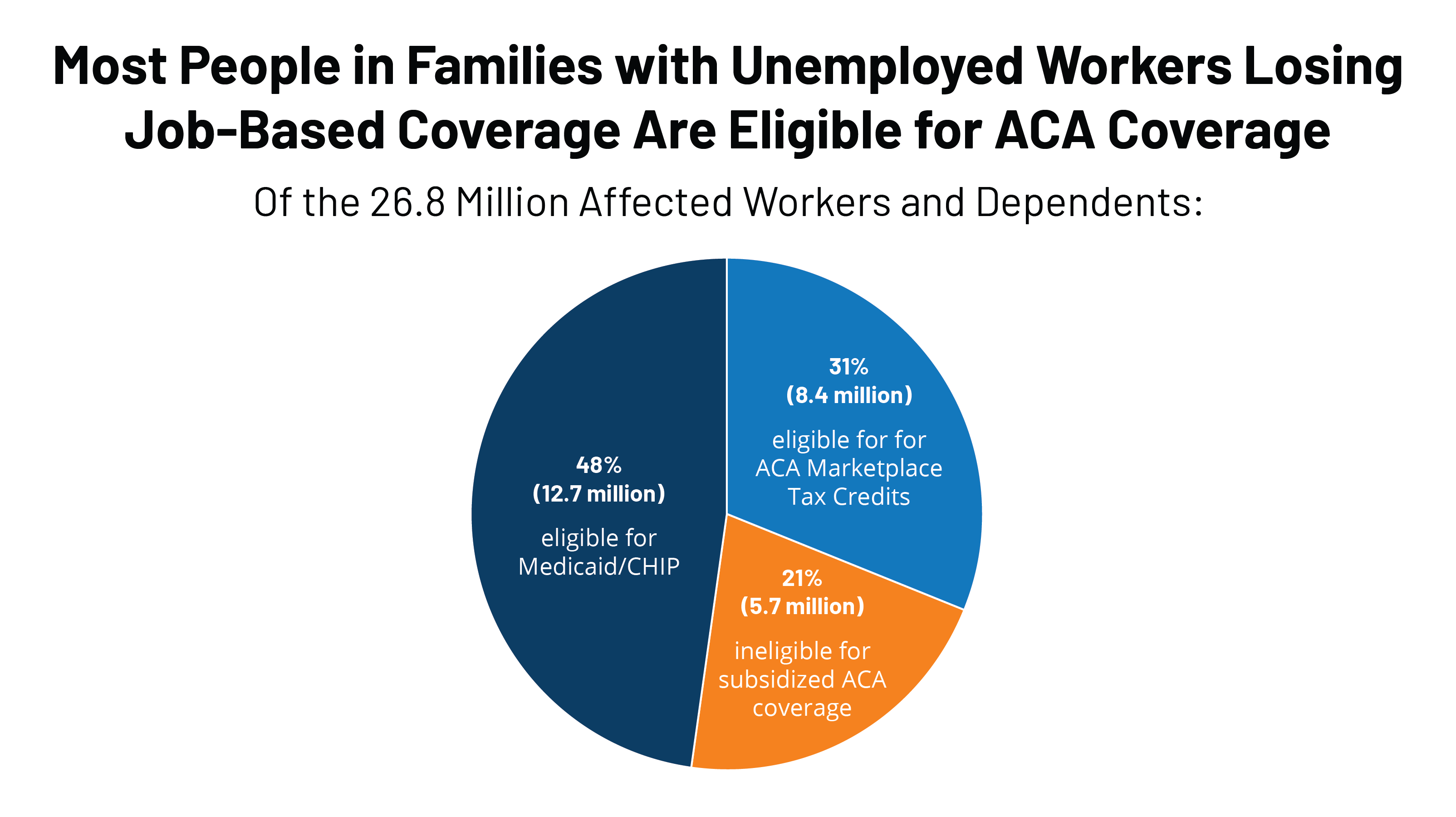

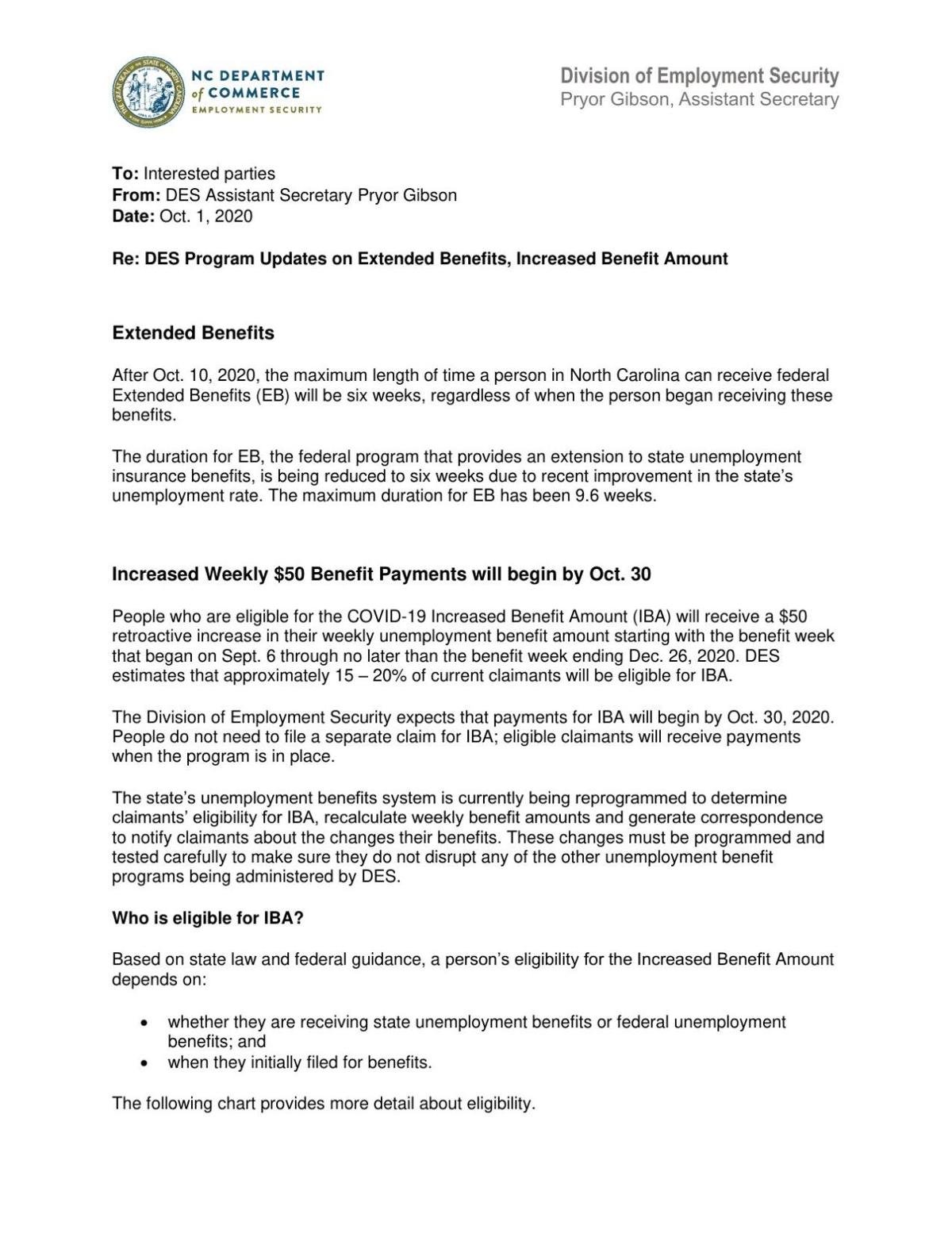

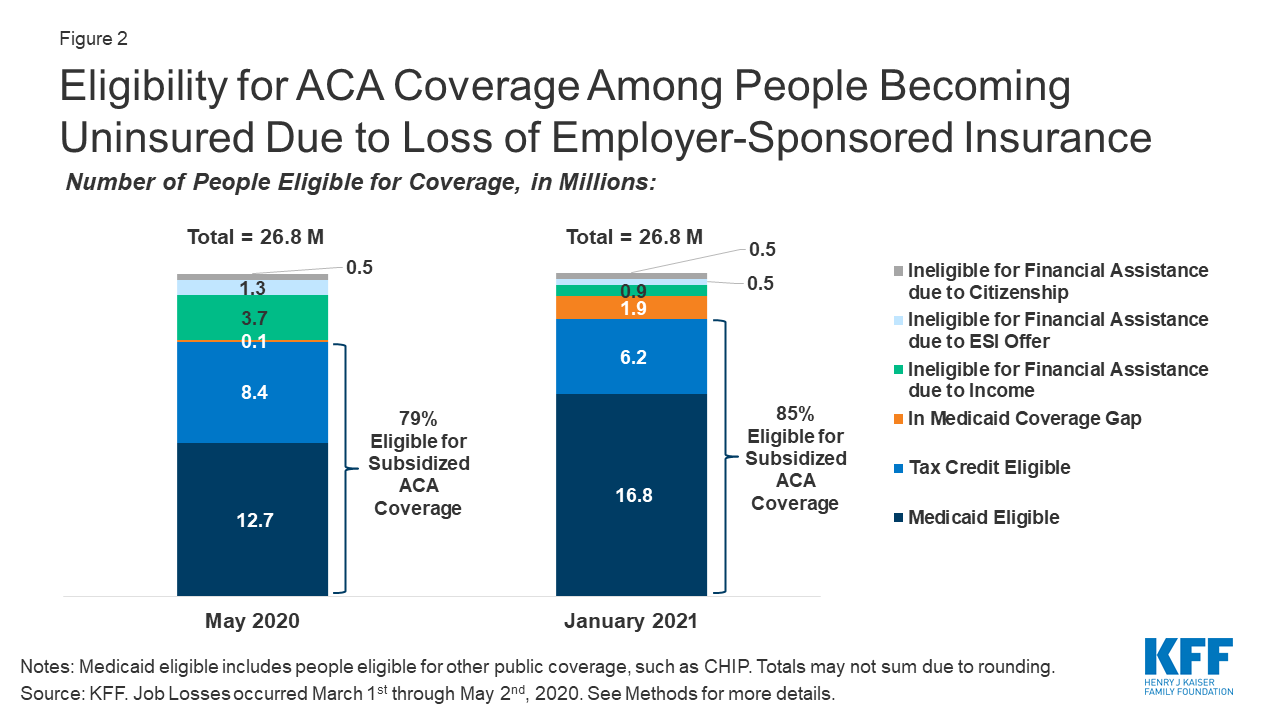

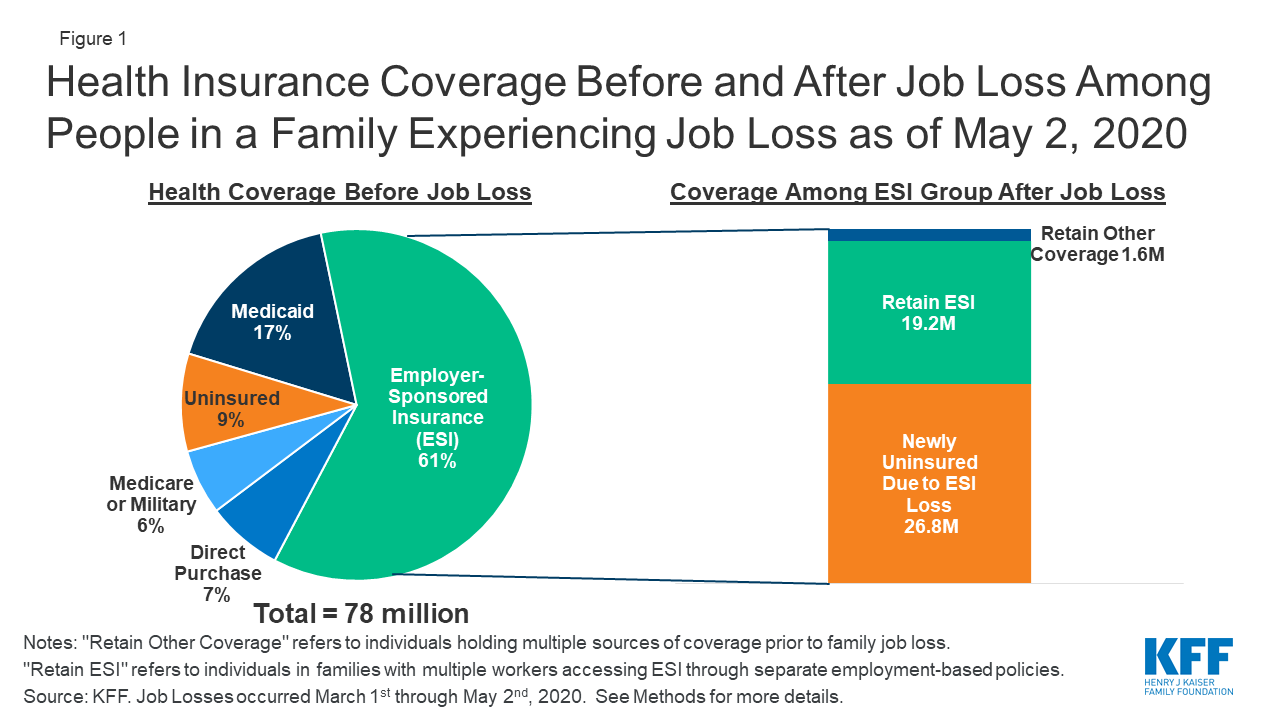

Eligibility For Aca Health Coverage Following Job Loss Kff

Well when shes in Florida for the winter is she a actively seeking work or b ready willing and able to work - in New York at least.

Can seasonal employees collect unemployment in ohio. MEUC benefits are available to eligible traditional unemployment claimants who also earned at least 5000 in self-employment wages during the year prior to when they first applied for unemployment benefits. Note that it is not possible to apply for. Payments available to employees who are out of work temporarily through no fault of their own.

Therefore should the well-paid seasonal restaurant worker be collecting unemployment benefits during the off-season. Seasonal Claim Individuals who worked for employers whose businesses do not operate year-round may qualify for benefits without having worked the usual minimum number of weeks. However a larger number of states are now saying that they shouldnt be able to take benefits and employers are often surprised to discover that in certain circumstances seasonal or temporary employees may still qualify for unemployment.

For more information please see the Unemployment Benefits. If the weekly benefit amount is 40000 and weekly earnings are 20000. State of Ohio unemployment benefits are capped at weekly payouts of 424 and are determined based on how much you earned with your last employer.

Traditionally many people who worked seasonal positions had been allowed to collect unemployment benefits. One of the arguments against providing seasonal unemployment. That being said many employers are providing their workers with alternate benefits in hope that they will serve as incentive for their workers to return during peak season.

To apply online employees should go to unemploymentohiogov. If so then yes. An example of how this is computed appears below.

Total earnings in week 20000. Given recent changes in state unemployment laws many seasonal workers find it hard to collect unemployment benefits. To apply for Seasonal Status call.

Under Ohio law if you receive a pension while you are claiming unemployment benefits your UI benefits will be reduced by the amount of the pension that you are receiving IF the payment from the retirement plan was under a plan maintained or contributed to by a base period employer or chargeable employer. 10 Does unemployment money come from Social Security. Seasonal employment relates to employers who operate.

Unemployment benefits are available to employees when they are no longer working through no fault of their own. You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. Pending MEUC claims may.

Unfortunately there is not a lot of clarity regarding who gets unemployment benefits and who does. Nor will a worker who makes 9 an hour and works 20 hours a week. 614 752-8419 Further questions may be directed to Julie Znamenacek.

To calculate the earnings deduction. Click here for a step-by-step guide to applying online. Also if the employer never makes work available in the new season and the worker applied for unem-ployment benefits and certified for benefits during the period between seasons the worker can collect retroactive benefits for the period between seasons.

No it is only part of the solution. Ohio residents who have recently lost their jobs might be eligible for unemployment benefits. Applying online is the quickest way to start receiving unemployment benefits.

Per Ohio Law if you are a present employee at the time of your claim your employer may not terminate your employment because you have filed a complaint. Ohio also has one of the toughest earnings requirements for unemployment insurance of any state in the country. The program provides a supplemental benefit of 100 per week for qualifying weeks of unemployment claimed between December 27 2020 and June 26 2021.

However benefits may be drawn only during the. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. It is important to know whether employees are properly categorized as Seasonal or Part-time to determine whether their filing for unemployment claims will financially impact your organization.

The state uses this information to determine you are searching for work and failing to file them will. 7 Can you collect unemployment if you are part time in Ohio. Although the basic rules for unemployment are similar across the board the benefit amounts eligibility rules and other details vary from state to state.

If there are issues on your claim this notification. This year an Ohioan who makes the federal minimum wage and is employed 37 hours a week all year long will not qualify for unemployment insurance. Any employer seeking to be determined a Seasonal Employer by the Director shall file with the Director a written application.

If employees dont have access to a computer they can apply by phone by calling 877-644-6562. 11 What are the cons of collecting unemployment. Your complaint will be reviewed by the Bureau of Wage Hour Administration and if accepted it will be assigned out to an investigator.

Workers in Ohio who have been laid off fired or forced to leave their jobs might be eligible for unemployment benefits through the Ohio Department of Job and Family Services ODJFS. She should be collecting unemployment. Ohio law allows that 20 of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made.

Ohio unemployment weekly claims are necessary to receive your benefits. Soon after approval you can begin collecting unemployment payments. If not then no.

12 Does collecting unemployment hurt. Are seasonal workers be allowed to collect unemployment checks in their downtime. Call center hours are Monday through Friday 7 am.

6 Can seasonal employees collect unemployment in Ohio. 9 Can you collect unemployment and still work in Ohio. In other words if the basis of your UI claim is that you lost your job with the.

The unemployed worker can collect unemployment benefits during that new season. If its rejected you will receive notice from the. 8 How many hours do you have to work to qualify for unemployment in Ohio.

Https Jfs Ohio Gov Ouio Pdf Quicktipsandstepbystepguide Pdf

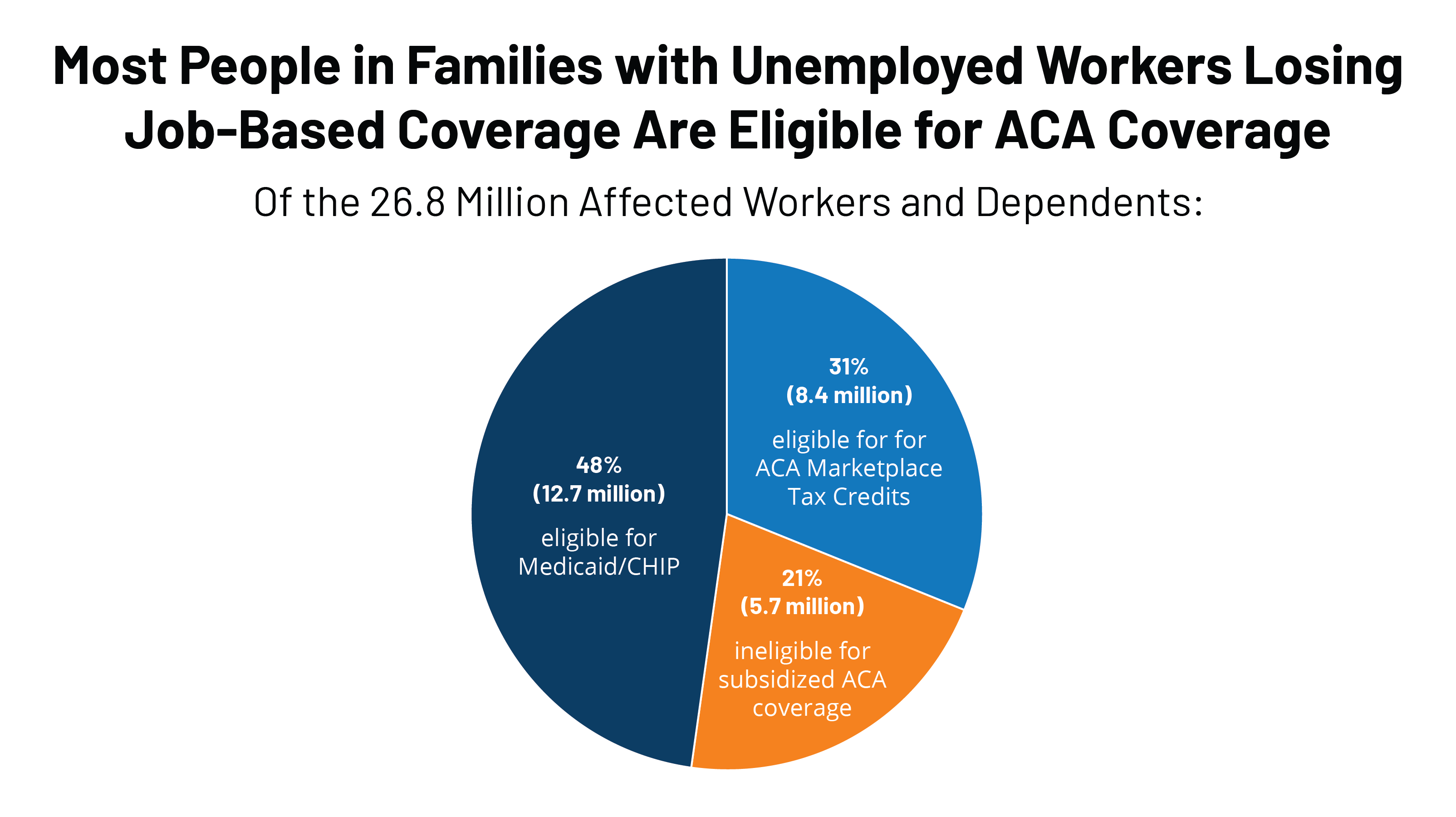

Free Employment Contract Templates Pdf Word Eforms

Coronavirus In Ohio Your Covid 19 Money Questions Answered

Https Marketing Sedgwick Com Acton Ct 4952 P 023b Bct Ct12 0 1 D Sid Tv2 3abejyl3qts

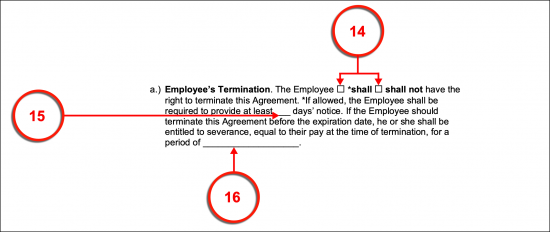

Extra 50 Payment In Regular State Unemployment Benefits Projected To Start By Oct 30 Local Journalnow Com

Coronavirus In Ohio Your Covid 19 Money Questions Answered

Guide To Ohio Employee Benefits During Covid 19 Gusto

Https Jfs Ohio Gov Ouio Pdf Quicktipsandstepbystepguide Pdf

Unemployment Resources And Toolkit Ucla Alumni

Https Www Jstor Org Stable 4165375

Eligibility For Aca Health Coverage Following Job Loss Kff

Can Fired Employees Collect Unemployment

Https Jfs Ohio Gov Ouio Pdf Quicktipsandstepbystepguide Pdf

How To Get Unemployment Benefits Even If You Quit Your Job Student Loan Hero

Ohio Department Of Job And Family Services Tries To Bolster Its Own Workforce By Posting Jobs With No Medical Benefits In Pandemic Eye On Ohio

Eligibility For Aca Health Coverage Following Job Loss Kff

Unemployment Benefits Comparison By State Fileunemployment Org

Post a Comment for "Can Seasonal Employees Collect Unemployment In Ohio"